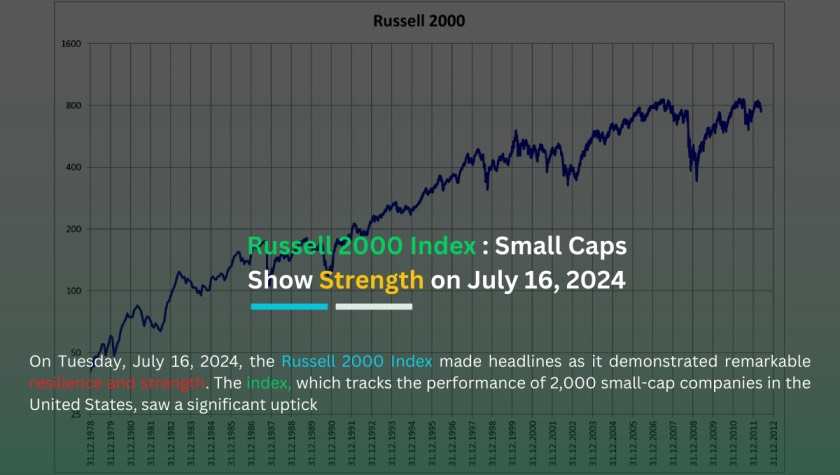

Russell 2000 Index : On Tuesday, July 16, 2024, the Russell 2000 Index made headlines as it demonstrated remarkable resilience and strength. The index, which tracks the performance of 2,000 small-cap companies in the United States, saw a significant uptick. This rise is noteworthy because the Russell 2000 often acts as a barometer for the health of smaller businesses in the American economy.

Russell 2000 Index: Small Caps Show Strength on July 16, 2024

The Russell 2000 Index was established in 1984 by the Frank Russell Company. It includes a diverse range of companies, primarily smaller firms that are often overlooked by larger indices like the S&P 500. These companies typically have market capitalizations between $300 million and $2 billion. Despite their smaller size, they play a crucial role in the economy.

Investors watch the Russell 2000 closely. It provides insight into the performance of smaller firms, which can be more sensitive to economic changes. On July 16, the index closed up by 1.5%, driven by gains in the healthcare and technology sectors. Analysts believe this boost was influenced by positive earnings reports and optimistic forecasts for these industries.

One of the standout performers in the healthcare sector was a small biotech firm that announced a breakthrough in cancer treatment. This news sent its stock soaring by 20%. Similarly, a tech company specializing in cybersecurity reported better-than-expected earnings, leading to a 15% increase in its share price. These companies’ successes highlight the potential for substantial growth within the small-cap sector.

The performance of the Russell 2000 is often compared to its larger counterpart, the Russell 1000, which tracks the 1,000 largest U.S. companies. While the Russell 1000 tends to be more stable, the Russell 2000 can be more volatile. This volatility can offer both higher risks and rewards for investors. On days like July 16, the rewards are evident, but it’s essential to remember that the index can also experience sharp declines.

The Russell 2000’s rise can be attributed to several factors. Firstly, the overall economic environment has been improving, with lower inflation rates and steady job growth. Secondly, smaller companies have been showing strong financial health, with many reporting higher revenues and profits. Lastly, investor sentiment has been positive, with many believing that small-cap stocks have significant growth potential.

Investing in the Russell 2000 can be an attractive option for those looking to diversify their portfolios. Small-cap stocks often perform well during economic recoveries, as they can grow faster than larger companies. However, they also come with higher risks. Investors need to consider their risk tolerance and investment goals before diving into this segment of the market.

For those interested in the Russell 2000, there are several ways to invest. One popular method is through exchange-traded funds (ETFs) that track the index. These ETFs provide exposure to a broad range of small-cap stocks, offering diversification benefits. Mutual funds are another option, allowing investors to pool their money together to invest in a managed portfolio of small-cap stocks.

It’s also important to keep an eye on market trends and economic indicators. The performance of small-cap stocks can be influenced by various factors, including interest rates, government policies, and global economic conditions. Staying informed and conducting thorough research can help investors make better decisions.

Read More :Tech Giant Google to Buy Wiz for $23 Billion

Conclusion

The Russell 2000 Index’s performance on July 16, 2024, highlights the strength and potential of small-cap stocks. With positive earnings reports and an improving economic environment, the index saw a significant rise. While investing in small-cap stocks can be risky, the rewards can be substantial for those willing to take the plunge. As always, it’s essential to do thorough research and consider one’s financial goals before investing.