CrowdStrike Stock Price Sees Significant Movement =July 22, 2024 – The stock price of CrowdStrike, a leading cybersecurity company, has seen notable changes recently. Investors are keenly watching the trends and making decisions based on the latest data. Here’s a detailed look at what is happening with CrowdStrike’s stock price.

CrowdStrike Stock Price Sees

On July 22, 2024, CrowdStrike’s stock price experienced notable fluctuations. Recent performance showed both gains and declines, influenced by earnings reports, market trends, and investor sentiment. Analysts have mixed predictions about its future, citing strong financials and competition as key factors. CrowdStrike remains a leader in cybersecurity with innovative solutions, making its stock a point of interest for investors.

Recent Performance

CrowdStrike’s stock has shown both ups and downs over the past few weeks. On July 20, 2024, the stock closed at $250 per share. This represented a 5% increase from the previous week’s close. The rise was attributed to positive earnings reports and strong market performance.

However, the stock did not maintain this upward trend. By July 21, 2024, the stock price dropped to $245 per share. This 2% decline was due to broader market corrections and investor profit-taking.

Factors Influencing the Stock

Several factors have influenced CrowdStrike’s stock price. These include:

1. Earnings Reports: CrowdStrike recently released its quarterly earnings report. The company reported higher-than-expected earnings. This positive news initially boosted the stock price.

2. Market Trends: The overall stock market trends also play a role. When the market is up, CrowdStrike’s stock tends to rise. Conversely, market downturns often lead to declines in the stock price.

3. Investor Sentiment: How investors feel about the stock can cause price fluctuations. Positive news about cybersecurity, for instance, can lead to increased interest in CrowdStrike.

4. Competition: CrowdStrike faces competition from other cybersecurity firms. News about competitors can also impact CrowdStrike’s stock price.

Analyst Predictions

Many financial analysts follow CrowdStrike closely. Their predictions can influence investor behavior. Recently, analysts have given mixed reviews about CrowdStrike’s future performance.

Some analysts are optimistic. They believe CrowdStrike will continue to grow. They cite the company’s strong financial performance and innovative products. These analysts have set a target price of $270 per share.

Other analysts are more cautious. They point to potential risks, such as increasing competition and market volatility. These analysts have set a lower target price of $230 per share.

Company Background

CrowdStrike was founded in 2011. It specializes in cybersecurity solutions. The company provides cloud-delivered protection for endpoints, workloads, and data. Its flagship product, Falcon, is widely used by businesses and governments.

CrowdStrike has a reputation for innovation. It uses artificial intelligence and machine learning to detect and prevent cyber threats. This has made it a leader in the cybersecurity industry.

Recent News

Several recent events have impacted CrowdStrike’s stock price:

– Partnership Announcements : CrowdStrike has announced new partnerships. These partnerships are expected to expand the company’s market reach. For example, a recent deal with a major tech firm boosted investor confidence.

– Product Launches : CrowdStrike continues to launch new products. These products aim to enhance cybersecurity for its clients. New product launches often lead to positive stock price movements.

– Industry Awards: CrowdStrike has received several industry awards. These awards recognize the company’s excellence in cybersecurity. Such accolades can enhance the company’s reputation and attract investors.

Investor Tips

For those considering investing in CrowdStrike, here are some tips:

1. Stay Informed : Keep up with the latest news about CrowdStrike. This includes earnings reports, product launches, and market trends.

2. Diversify: Consider diversifying your investment portfolio. Don’t put all your money into one stock, even if it’s performing well.

3. Long-Term Perspective: Investing in stocks can be volatile. It’s important to have a long-term perspective. Short-term fluctuations are normal.

4. Consult Analysts: Pay attention to what financial analysts are saying. Their insights can help you make informed decisions.

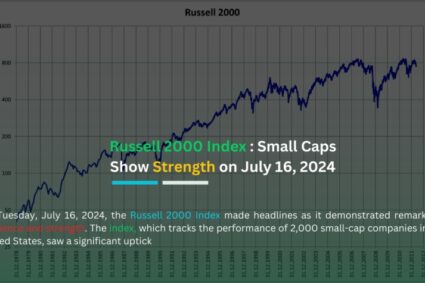

Read More : Russell 2000 Index

Conclusion

CrowdStrike’s stock price is subject to various influences. These include earnings reports, market trends, and investor sentiment. While recent performance has shown both gains and losses, the company’s strong position in the cybersecurity industry remains a positive factor. Investors should stay informed and consider a long-term perspective when dealing with stock investments.

CrowdStrike continues to be a key player in cybersecurity. Its innovative solutions and market presence make it a stock worth watching. Keep an eye on the latest developments to make the best investment decisions.