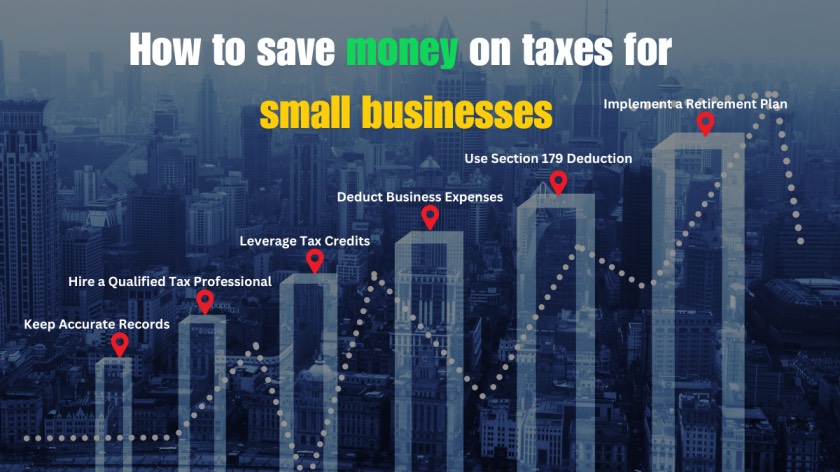

How to save money on taxes for small businesses : Running a small business comes with many challenges, including managing taxes. Reducing tax liabilities can significantly impact a business’s bottom line. Here are some effective strategies for small businesses to save money on taxes:

How to save money on taxes for small businesses

1. Keep Accurate Records

Maintain detailed and organized financial records throughout the year. This practice makes it easier to identify deductible expenses and ensures you claim all eligible deductions. Use accounting software to track income, expenses, and other financial transactions.

2. Hire a Qualified Tax Professional

Consider hiring a CPA or tax advisor with experience in small business taxes. They can help identify deductions and credits you might overlook. A professional can also ensure compliance with the latest tax laws and regulations .

3. Leverage Tax Credits

Take advantage of tax credits designed for small businesses. These may include credits for hiring employees, providing healthcare, and investing in energy-efficient equipment. Tax credits directly reduce your tax bill and can result in substantial savings.

4. Deduct Business Expenses

Claim all eligible business expenses. These can include office supplies, utilities, travel expenses, and more. Make sure the expenses are necessary and ordinary for your business to qualify for deductions .

5. Use Section 179 Deduction

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This deduction can significantly reduce taxable income .

6. Benefit from the Home Office Deduction

If you operate your business from home, you may qualify for the home office deduction. This allows you to deduct a portion of your home-related expenses, such as mortgage interest, rent, utilities, and insurance, based on the percentage of your home used for business .

7. Implement a Retirement Plan

Setting up a retirement plan for you and your employees can provide significant tax benefits. Contributions to plans like a SEP IRA, SIMPLE IRA, or 401(k) are tax-deductible, reducing your taxable income.

8. Consider Health Insurance Deductions

If you provide health insurance to your employees, you might be eligible for the Small Business Health Care Tax Credit. Additionally, self-employed individuals can deduct health insurance premiums for themselves and their families.

9. Defer Income and Accelerate Expenses

To manage tax liability, consider deferring income to the next tax year while accelerating deductible expenses into the current year. This strategy can be particularly useful if you expect to be in a lower tax bracket in the coming year.

10. Utilize the Qualified Business Income (QBI) Deduction

The QBI deduction allows eligible businesses to deduct up to 20% of their qualified business income. This deduction is available to pass-through entities like sole proprietorships, partnerships, S corporations, and some trusts and estates.

11. Track Vehicle Expenses

If you use vehicles for business purposes, keep detailed records of your mileage and related expenses. You can deduct either the actual expenses incurred or use the standard mileage rate, whichever results in a higher deduction.

12. Incorporate or Form an LLC

The structure of your business can impact your tax liabilities. Forming an LLC or incorporating your business can provide tax benefits and protect personal assets. Consult with a tax advisor to determine the best structure for your business.

By implementing these strategies, small business owners can reduce their tax burden and retain more of their hard-earned income. Always consult with a tax professional to tailor these strategies to your specific situation and ensure compliance with current tax laws. For more detailed guidance, refer to resources like SCORE’s comprehensive tax-saving strategies for small businesses.

Read More :comprehensive financial planning checklist

Conclusion

managing taxes effectively is crucial for the financial health of small businesses. By keeping accurate records, hiring a qualified tax professional, leveraging tax credits, and deducting all eligible business expenses, small business owners can significantly reduce their tax liabilities. Utilizing the Section 179 deduction, taking advantage of the home office deduction, and implementing a retirement plan can also lead to substantial tax savings. Additionally, considering health insurance deductions, deferring income, and accelerating expenses, and utilizing the Qualified Business Income (QBI) deduction are smart strategies. Tracking vehicle expenses and choosing the appropriate business structure, such as incorporating or forming an LLC, can further optimize tax outcomes.

By following these strategies and consulting with a tax advisor to tailor these approaches to their specific situations, small businesses can retain more income and invest in their growth. For detailed guidance, resources like SCORE offer comprehensive tax-saving strategies that can be immensely helpful.